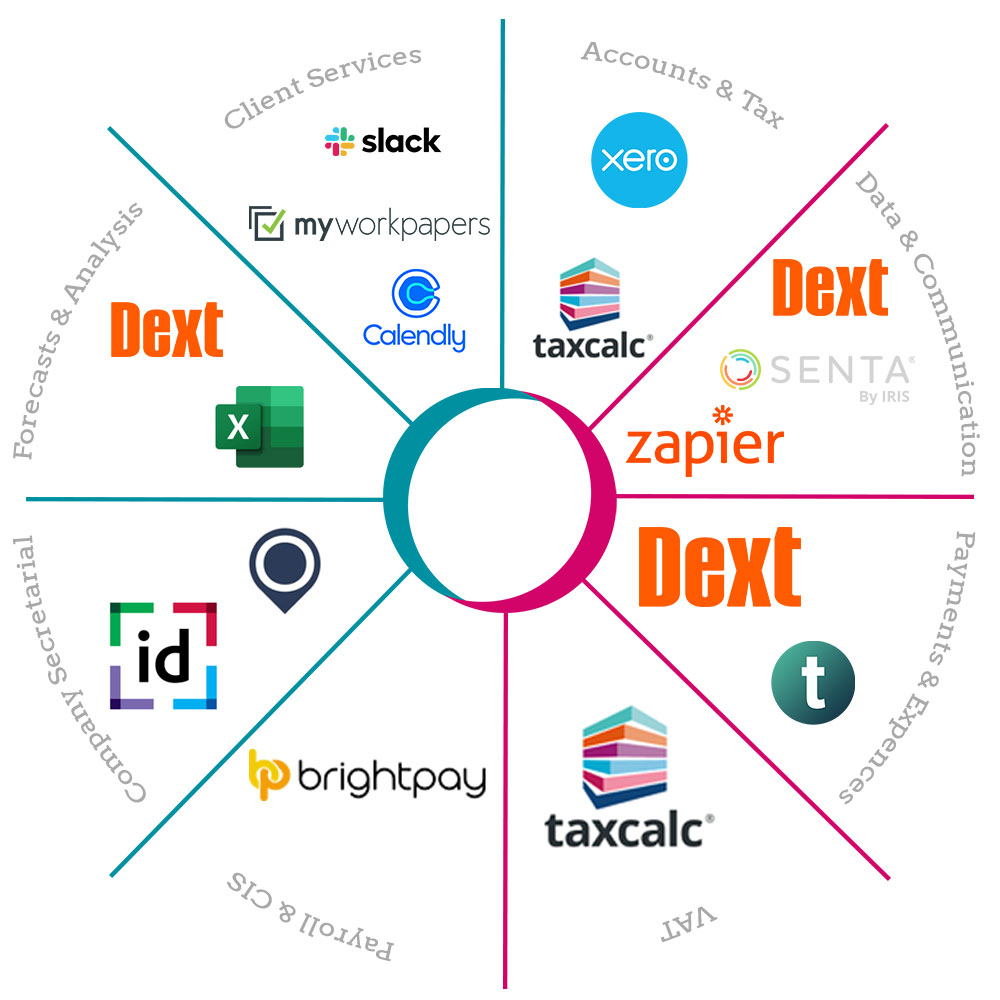

We believe in transparent and data-driven pricing. There cannot be a one-size-fits-all-fee because your Service Proposal is designed for you alone. We will provide clear explanations and advise you on your best solution for services and technology.

Bookkeeping & Payroll

With us doing your bookkeeping, you can keep track of your finances with confidence. We recommend that most businesses raise their own sales invoices and leave bank reconciliations, purchase invoices, and cr control in the capable hands of our bookkeepers. When all is said and done, if your bank account does not reconcile, nothing else matters – it is, without doubt, the most important financial control and this is why. Doing your bookkeeping properly requires a full understanding of tax and VAT rules.

Payroll sounds easy enough. Right? It is just paying people. Red Adair had it spot on: “If you think it’s expensive to hire a professional to do the job, wait until you hire an amateur.” In our experience, payroll can go wrong very quickly and very badly. We never underestimate the importance of getting it right – you are affecting people’s ability to pay their rent… insure their car…do their grocery shop. We offer a full payroll service from calculating the deductions and submitting pensions to paying people & HMRC. You will also get to use the excellent BrightPay. This GDPR-compliant, online portal provides HR functions like holiday booking and gives both the employer & employees access to all their important payroll documents.

Your business needs a set of accounts that meets HMRC’s rules to support your tax return. Some tax law applies to all businesses but there are big differences in specific areas such as travel & subsistence or entertainment. For that reason, we think it is in our clients’ best interests to organise ourselves into specialist teams that work with sole traders & partnerships and limited companies.

Depending on the legal structure you use, you may also be required to file statutory accounts with Companies House. This is one of a range of legal duties that company directors and LLP members have – we can guide you through all of these responsibilities and make sure you never miss any deadlines.

Accounts & Tax

VAT – if you believe some software providers, you only need to hit a button and hey presto your return is filed. Accountants are known for their love of acronyms and the one we use here is RIRO. It stands for “rubbish in, rubbish out”.

Advice & Planning

Budgets, cash flow forecasts and management accounts are all essential tools for successful businesses looking to grow but, realistically, most cannot afford a dedicated resource. As your accountant, we are perfectly placed to step into the role as a Virtual Financial Controller or Finance Director.

You work hard and want to make sure that you make use of the reliefs open to you. We are here to make sure that you understand your options and always comply with the law. We offer a tailored range of Checks and Planning.

We can provide you with a Quarterly Tax Pack so that you know how much profit you have made so far, what you have taken out of the business (and what you could take if you wanted to), how much you should have saved towards this year’s tax bill, and when that will need to be paid. If there have been any tax changes since your last pack, we will make sure you know how they might affect you.

You have 3 very simple legal duties:

- File a correct & complete tax return

- Pay your tax

- Do both of those things on time

You cannot delegate those responsibilities but you can get yourself a trustworthy accountant. We kick off a 10-step process as soon as the tax year is over. This is our strategy: we help you to get all the paperwork to us by 31 July, your return is filed by 30 November, your tax gets paid on 31 January.

Personal Tax

We can also help with tax compliance & planning outside of your self-assessment return. Whether you have sold an investment property, want to calculate your pension allowance for the year, are granted share options, or want to understand the tax implications of investment decisions, we have the expertise in house to advise and guide you.